Managing your Marriage and Finances

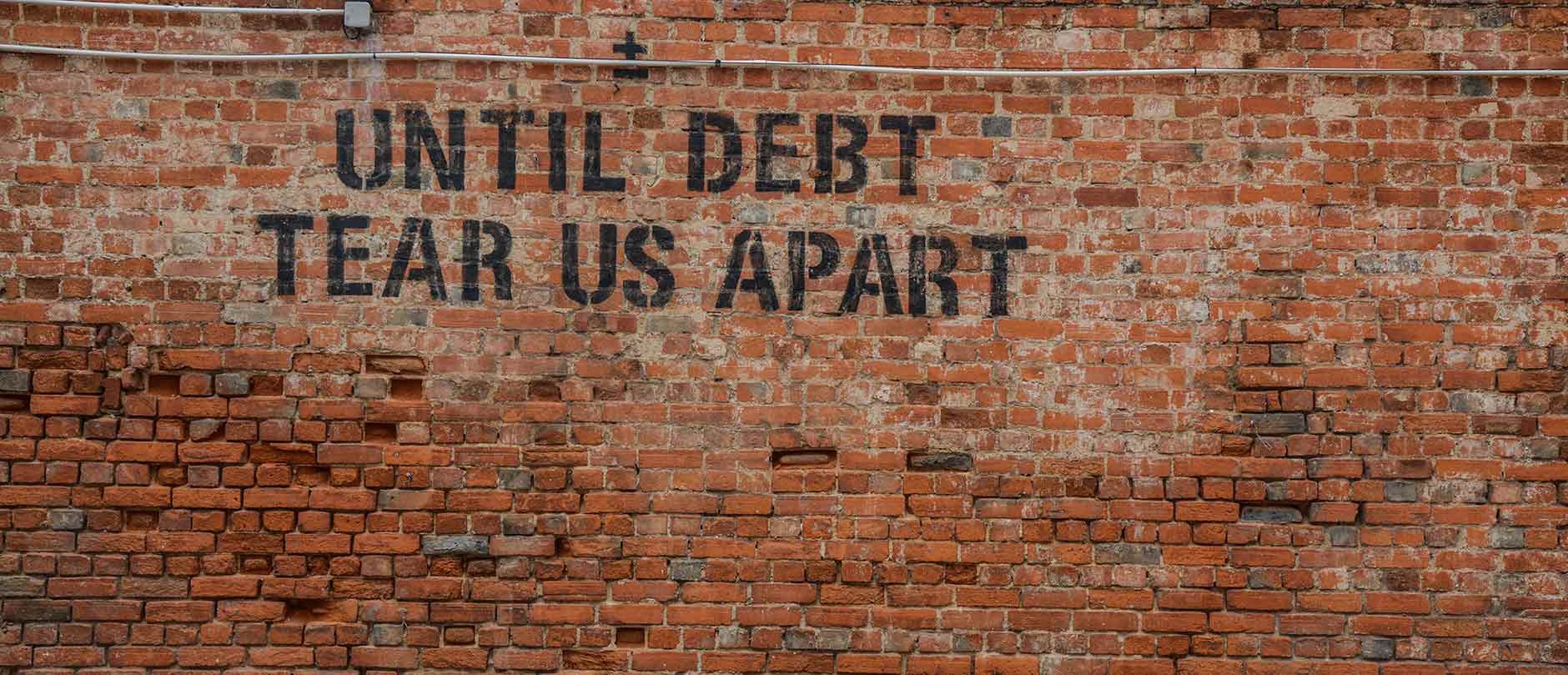

One of the difficult discussions you can have with your spouse is how to manage your finances. Before, you were used to handling everything by yourself. Now you are married and are wondering how you will balance your accounts with someone else. It can be challenging, but there are ways you can transition into joint financial decision making easier.

Talk with your Partner

Through this series, we have insisted that you need to communicate with your partner. You are no longer alone. Now, you have someone else you need to involve in your decision making.

What you want to do is talk about the income you’ll both be making as a whole, purchases that need to be made, how much money will be saved, and how much debt you both have. It’s always best to start with talking so that you and your partner both get a good understanding of how money will be handled in your marriage.

If you find that you have several distractions at home, you can choose to have your discussion at a restaurant or somewhere you can both be alone.

Plan your Future

Everyone has their own goals and their own idea of the perfect future. No doubt you and your partner are the same way, so talk about what goals you both have financially. Travelling or going on vacation, buying a home together or purchasing a new car, whatever your goals are, make sure to discuss them with your partner and write them down so you remember them.

Joint or Separate?

When you are getting married, you want to decide going forward whether you’re both going to keep separate accounts, have joint accounts, or even both.

Most couples tend to create a joint bank account together as it builds trust between the two of them and it’s also much simpler to have all bills going to one account with both of your earnings there. This way, both people are also purchasing everything together with their money, rather than his money or her money.

A smart tip to keep in mind when talking with your significant other about finances or possessions such as your house or money is to call them ‘ours’ instead of ‘mine’ or ‘yours’. This will help build solidarity and reinforce the idea that you are a team going forward.

Some couples do choose to keep separate bank accounts though. Everyone has their own reason for everything, and if you’d like to keep separate accounts to manage money better then by all means, that is your choice to make.

Build your Budget

Before you got married, you were used to having a budget for yourself. Now that you’re married you need to accommodate your partner as well. Another person means more money on food, gas, and other bills, so keep in mind that you might be limited on splurging for a while. Plan when you’ll do groceries and how much you’ll spend, approximate how much your monthly utilities will cost, calculate recurring expenses such as rent and how much money you’re willing to set aside for entertainment like date nights.

Start Saving Up

It is important that you both communicate the idea of saving to each other, even though you have more income. You both have goals that will require both time and money to achieve them. How will you get the money? The answer is through saving. Limit unnecessary purchases and instead put that money aside. A great way to start up a savings account is to take a certain amount of money from each paycheck you get and put it aside. This way you will have a set amount each time you get paid that will go straight into your savings account.

Saving is not only for couples but for everyone.

You can establish and build an ‘Emergency Fund’ as soon as possible. An emergency fund is a stash of savings used only in emergencies such as losing a job, having an accident, or anything else life can throw at you. An emergency fund is essentially self-insuring yourself. A fund of at least 2 months should be enough for the bare minimum, but we at EventDone can only recommend at least 3 months as our bare minimum, and that is if you’re single.

If you are a couple and have children, we recommend an emergency fund of at least 6 months, this can guarantee the continual comfort and safety of your family while giving enough time to deal with the emergency as appropriately as possible. 6 months of all living expenses can seem like a lot, and it is. But an emergency fund is meant to be established over time, and to be used in the times that you don’t have time to relax.

Make Responsibilities Equal

Even though money may be coming in from both of you, make sure that the responsibility of saving and sticking to a budget is on both of you. If you’re both going to take $50 from your paycheck to put aside from savings, make sure both you and your partner are doing it and not just one of you.

Also, if you happen to be the one handling all the money then make sure to include your partner in decision making and let them know what's going on. If you’re going to be making a big purchase or pay bills, let your partner know about what you are doing so they are not left in the dark.

If you’re a couple with a single breadwinner, then the previous paragraph is especially important to take to heart. Taking on all the decisions of a role, whether it be handling money, handling parenting, or handling home base, may seem like a good idea as a division of labor, however over time, it may strain the relationship. Sharing decisions takes the load off a single person’s shoulder, and allows for thinking as a team, building trust and solidarity.

Work Together

Managing money after first getting married can be difficult, but it can be made increasingly difficult if only one person in the relationship is managing it all. Help your partner out with their duties, while keeping in mind that the job they’re taking on may be stressful so maintain mindfulness. Make sure that you both have the same goals and you’re both following the same budget. If one of you overspends continuously or doesn’t seem to care much, it can be hard on the other. Working together is a key step to making sure it all goes smoothly.

Honesty is the Key to Trust

If you want trust from your partner, you have to trust them first. For you to gain that trust together, you must both be honest with each other on purchases made and how it’s going with the money. If one of you overspent or missed a bill payment, don’t try to hide it from your partner. Be honest with them and let them know that you made a mistake so that you both can work to fix it.

Handling finances in a marriage will be different for everyone. Some people will naturally have an easier time with money, while others will need to stick to stricter budgets. Whatever the case is for you, if you take this advice then you’ll be able to manage the finances in your relationship with ease, and you will be able to save up security and peace of mind for the future.